We can all agree that end-of-life planning isn’t the most exciting topic, and even more, doing the work of creating a will can seem like a daunting task. However, there is no better time than now to check this item off your to-do list. You’ll have peace of mind for years to come, and the process is easier than you might expect.

Read on to learn how to set up your will, and how we can help you connect all the moving parts to make the process as simple as possible.

Do I need a will or an estate plan?

Most people need a will, rather than an estate plan. An estate plan is more complex and is best for people with a large estate who want to minimize the probate process and reduce related expenses and delays.

Why wills are important

Having a will in place ensures that you have full control of what happens after you’re gone: If you want a certain relative to raise your child, or you wish to donate certain items to a charity, this ensures that the law is on your side and your wishes are met. Even if you don’t have children, you can build a will that protects your most valuable assets (your home, vehicles, pets, valuables, etc.).

Steps for creating your will

Once you plan out everything you want to include in your will, you can plug it into an online program or contact an attorney to help you finalize the document.

Decide what to include

The first step is to decide what you want to include in your will. It can be as elaborate or as basic as you want. Keep it simple by splitting assets equally among your beneficiaries or dig in and prioritize who gets what – it’s all up to you.

Include these items in your will:

-

Property (real estate, land, buildings)

-

Money (checking accounts, savings, money market, etc.)

-

Stocks, bonds, copyrights

-

Assets like vehicles, boats, artwork

-

Sentimental items like jewelry, mementos, furniture

Wondering what happens to the small stuff? You can designate a “residuary beneficiary” who will be responsible for taking over all the remaining assets. This person can then distribute remaining items to family members, charity, or a local donation center.

Choose a beneficiary

The next step is to choose a beneficiary. If you have a

life insurance beneficiary

, you know exactly how this works. Your beneficiary can be a family member, friend, charitable cause, or anyone you choose. You can also choose multiple beneficiaries. Your beneficiary will receive the assets specified in your will.

Name an executor

From there, you’ll want to choose an executor to carry out the terms of your will. Don't forget to reach out to your chosen executor to let them know that you are listing them in your will!

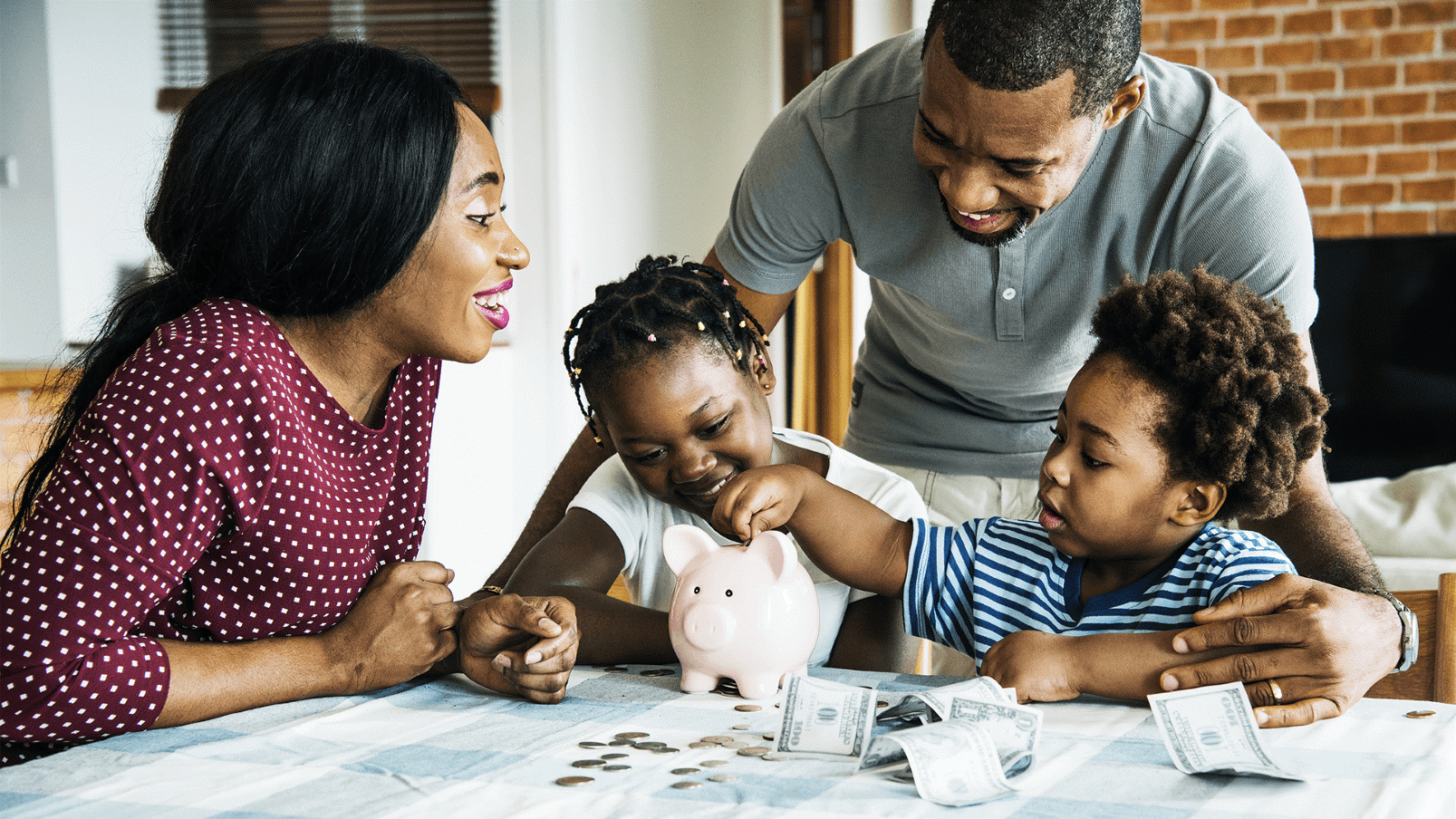

Choose a guardian of the estate

You’ll also want to consider who you want to be the guardian of the estate: aka the person who manages the assets you leave behind for your children. If you have life insurance and die while your policy is active, your children will receive a death benefit. It’s important to select someone you trust to manage the money in a way that best supports your children.

Sign + notarize

After listing everything you want to include in the will, you will need to sign it in the presence of at least two to three witnesses and get it notarized. There are online programs available to help you build and sign your will, or you can contact a local attorney to support you through the process.

Things you can’t include in a will

If you don’t own something entirely, you won’t be able to put it in your will. This includes a home you own with your spouse, insurance policies or retirement plans that clearly state a beneficiary, and certain stocks or bonds.

A note about social media:

When you pass away, your loved ones might not be able to access your email, Instagram, Twitter, Facebook, or other social media accounts. Disabling these accounts after a loved one’s death can get tricky, and laws vary state-by-state. If you want to have a plan in place, check your state’s digital estate legislation.

Where to store your will

Store your will in a safe location. Many people keep their will in a locked safe in their home or at their bank. If you do this, make sure that a loved one either knows how to crack the code on your home safe or has authorization to access the safe deposit box at your bank.

The most important thing is that you create a will and let someone know where to find it.

When to re-evaluate your will

If you experience a significant change in your life, you might need to reconsider parts of your will.

Life events that might affect your will:

-

Getting married

-

Having or adopting children

-

Buying a home

-

Getting a divorce

-

Death of a family member

-

Opening new financial accounts

-

Choosing a new beneficiary

The bottom line

Creating a will, just like having

life insurance,

is a great way to ensure your loved ones aren’t left with a mess when you pass away. Want to learn more about

getting life insurance

to include in your will? We can help with that too. Let’s get started!