Everyone can benefit from purchasing life insurance. Whether you have a spouse or dependents who rely on your income, own a small business, want to leverage the savings components inside

universal life insurance

, or simply want to provide liquid assets that can be used to pay for your final medical bills; life insurance can help protect your loved ones.

Choosing the right type of insurance policy and determining the amount of coverage you need isn’t necessarily intuitive. Here are seven things you should consider when you’re evaluating

life insurance options:

1. Affordable Coverage

One of the most important things to consider is whether you will be able to afford to keep coverage in place. As you weigh quotes for

term insurance

against more expensive

universal life insurance

policies, remember that with term insurance, you are simply purchasing life insurance protection without the cash value component included in universal life policies. Also remember that term coverage will come to an end. If you want to renew it when the initial term expires, you’ll pay higher premiums based on your then-attained age.

However, you also shouldn’t buy a universal life policy that comes with premium payments that are too high for your budget today. If you’re concerned about being able to maintain premiums on universal life coverage, talk to your independent insurance agent about using a combination of term and universal life policies to give you the protection your loved ones need, at a price you can afford.

2. Underwriting Considerations

If you’re in perfect health, you should qualify for “preferred” or “super preferred” rates with many insurance carriers. If you have one or more underlying health conditions though, don’t make the mistake of thinking you have to go with one insurance company simply because they offer you coverage or that you are uninsurable simply because one company denied your application.

The ways insurance carriers decide to price policies based on risks like smoking, chronic health conditions or personal activities can vary widely. Many more insurers today are offering coverage for people with ongoing medical conditions when those conditions are under control. Your insurance agent will play an invaluable role in helping you match with companies that will cover you, and in helping you evaluate coverage terms.

3. Term-to-Perm Conversion Options

If you decide to buy a term insurance policy now but think your coverage needs may change in the future, find out whether the policy includes a conversion option. If it does, you should be able to convert that term policy into whole life or universal life coverage later, without having to provide evidence of insurability at the time of conversion. Not all term policies include the option to convert coverage, so ask your insurance professional to confirm its availability.

4. Lifetime Benefit Options

The idea that your life insurance policy benefits only your policy beneficiaries isn’t strictly true anymore. Many insurance policies offer living benefit options for policyholders. Those benefits can take different forms, including long-term care,

disability

or

critical illness insurance

benefits. You may also be eligible for early payment of benefits if your life expectancy is short and you need funds to help pay for end-of-life care.

If this is important to you, let your agent know so he or she can help you find coverage that includes living benefit options.

5. Premium Payment Methods

When you buy life insurance, you are likely purchasing it so that the policy will be there for your loved ones when you die. The last thing you want to have happen is for the policy to lapse and coverage to end just because you missed a premium payment.

Look for life insurance policies that include automatic withdrawal options for policy premiums, so you can be confident that your insurance bill will always be paid on time and coverage will be there when needed.

6. Policy Exclusions in Early Years

Don’t be drawn in by life insurance quotes on TV that look too low to be true – there’s often a catch. In some cases, that catch is that the policy will not pay benefits (or won’t pay the full amount of benefits) if you die during the policy’s early years.

While everyone hopes the date will be far in the future, none of us knows when we’re going to die. Look for life insurance designed to pay the full death benefit amount – regardless when your death occurs. That way, you can have the peace of mind that comes from knowing your loved ones will be protected.

7. Consider the Cost of Waiting to Buy Coverage

Finally, as you evaluate life insurance options, don’t be tempted to put a decision on the back burner thinking you’ll come back to it later. The best time to buy life insurance is now. That’s because the premiums you’ll pay are based largely on your attained age, and you’ll never be younger than you are today.

Work with a skilled insurance professional who can help you find insurance protection now, and you can cross “Buy life insurance” off your to-do list.

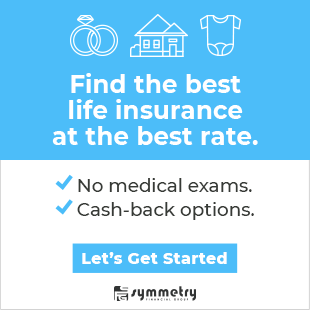

Symmetry Financial Group Can Help You Find Life Insurance Solutions Designed to Meet Your Needs

If choosing the right life insurance coverage seems overwhelming or confusing, the good news is that you don’t have to go it alone. The knowledgeable, experienced independent insurance agents at Symmetry Financial Group are here to help.

As a truly independent insurance provider, Symmetry Financial Group doesn’t sell any proprietary products. Instead, we partner with dozens of well-known, reputable insurance carriers. When we work with you, we’ll ask you questions about your goals, financial situation, dependents, and your budget, so we can help you

find insurance coverage

designed to fit your life.

To learn more and to get started, contact us

online

today.